On this page

| How it works |

| Growth |

| Benefits |

| Our projects |

| FAQs |

On this page

| How it works |

| Growth |

| Benefits |

| Our projects |

| FAQs |

Our heat and power generating plants play a significant role in supplying the Danish district heating and electricity grids. Our plants allow for great flexibility of supply depending on current needs and do so at a competitive price.

In the past, the plants ran on various fossil fuels, including large amounts of coal. Today, we’ve almost entirely converted them to operate without coal, with sustainable biomass providing the main low-carbon alternative to the heavily polluting fossil fuel, and natural gas being used in some plants.

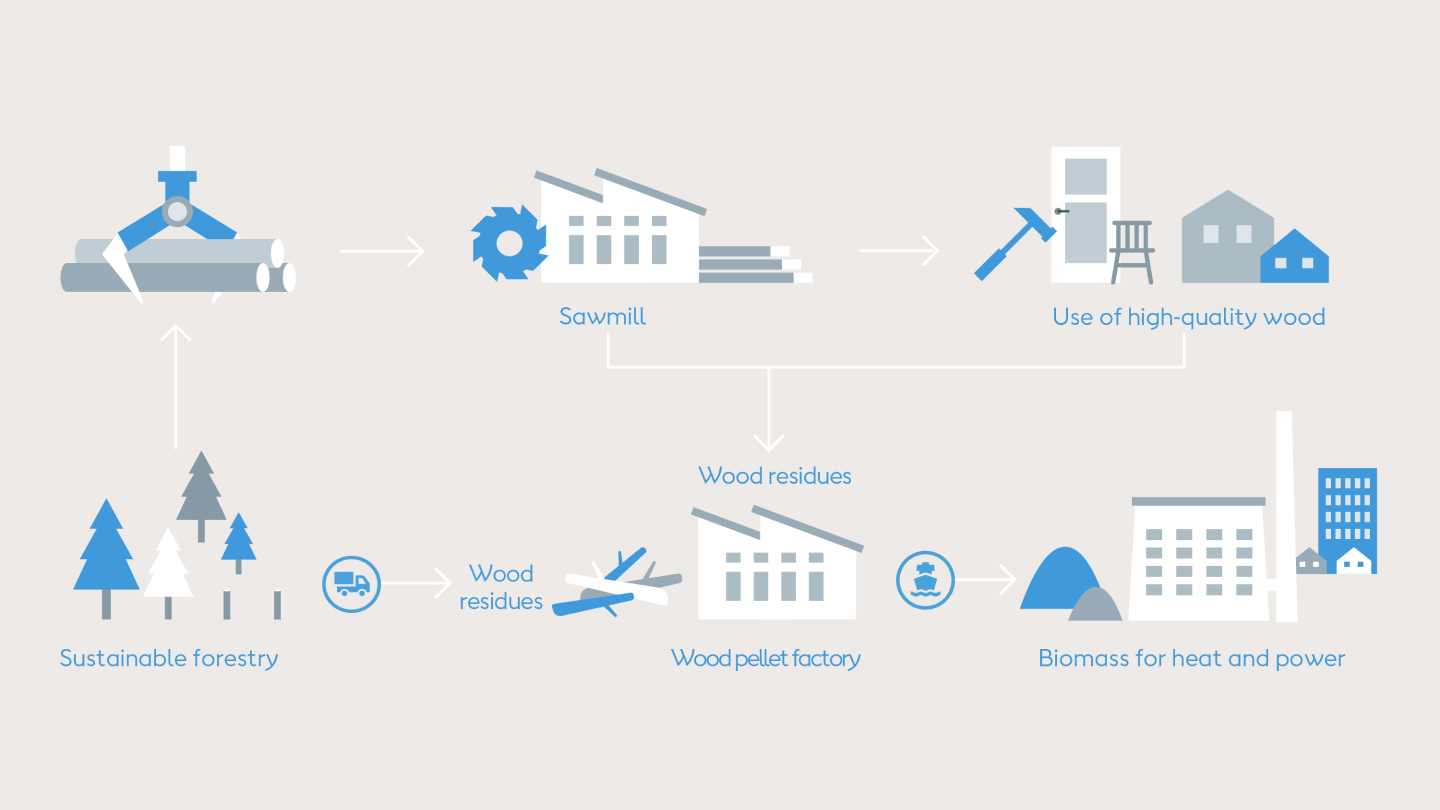

Our biomass is primarily wood pellets and wood chips derived from wood residues from sustainable forestry.

As long as biomass is sustainably sourced, it’s considered a CO2-neutral fuel because it emits the same amount of CO2 from burning as it absorbs during growth. Energy generated by using biomass is called bioenergy.

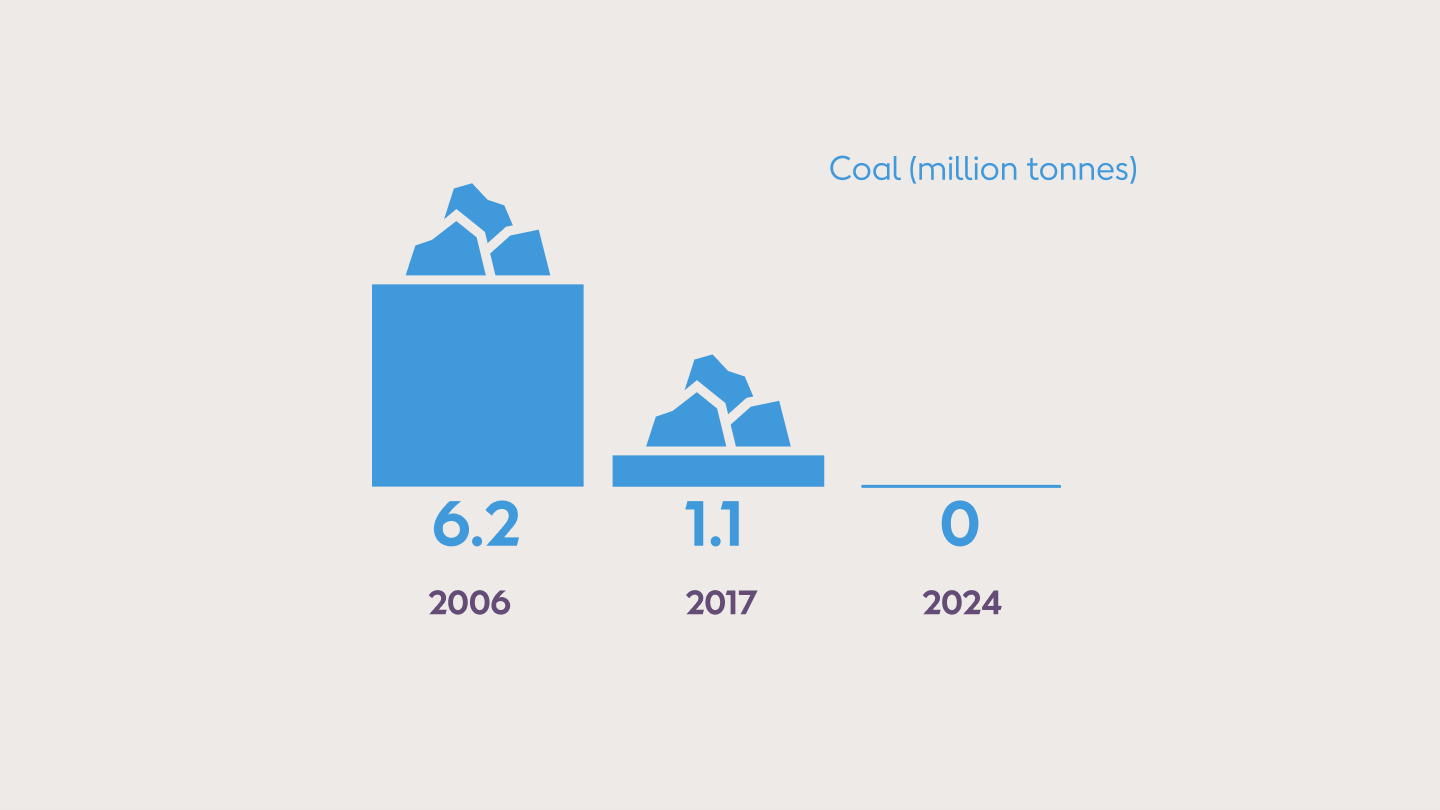

We’ve reduced the coal consumption in our heat and power production by 91 % since 2006 by replacing it with biomass, which is carbon-neutral. By 2024, we’ll have fully phased out the use of coal in our operations*. This’ll mark the end of a chapter in our green transformation story.

Starting in 2025, we’ll capture carbon from our Avedøre and Asnæs power stations. The captured carbon will then be sailed to Norway where it’ll be stored in a reservoir in the North Sea.

By capturing carbon from biogenic sources, we will achieve negative emissions.

Find out more about our carbon capture project and how it works

While our heat and power plants continue to play an important role in our low-carbon energy business, building new ones is not part of our strategy for the future.

With the increasing green electrification of Denmark’s energy system, the role of our heat and power plants is primarily to produce heating for the Danish district heating system and backup power for the Danish electricity grid.

In future, cost-competitive alternatives to heat and power plants are expected to be technologies like:

Over time, they can replace and supplement a substantial part of the sustainable biomass in Danish district heating.

We operate our seven large-scale combined heat and power (CHP) plants, one heat plant, and one peak load power plant as efficiently as possible, minimising environmental impacts.

See all our heat and power plants, their capacity, the fuels they run on, and more